Buying travel insurance can be confusing. Does my credit card cover it? What’s covered and what isn’t? How long does it take to get reimbursed? These questions are often tough enough to answer for an annual vacationer, but for those of us on the road frequently, they’re complicated even further because we need something that covers a lifestyle rather than a single trip. If you travel more than three weeks out of the year, buying one-off policies simply isn’t worth the hassle, and new evolutions in how travel insurance can work also make it financially unviable.

As a Frequent Traveler, This Annual Travel Insurance Gives Me the Most Peace of Mind

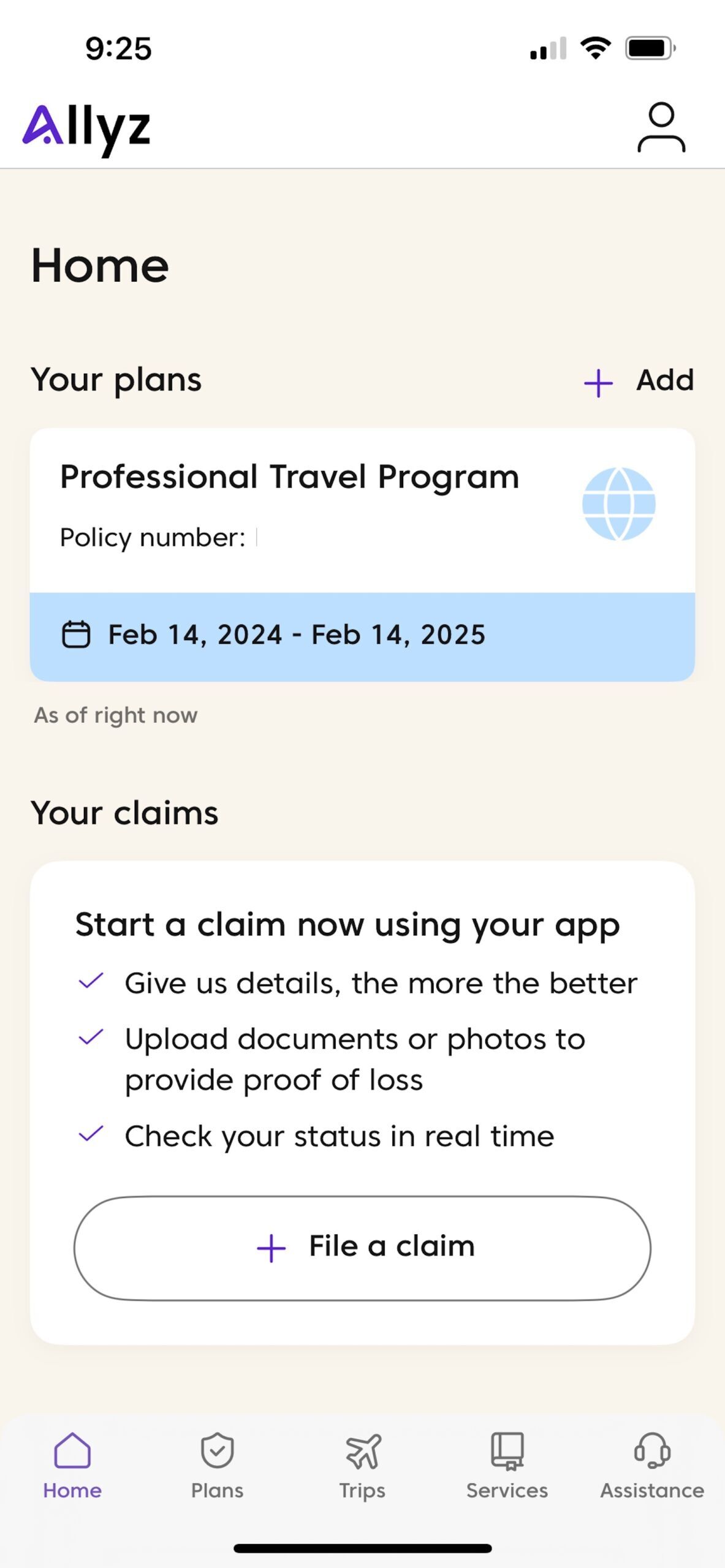

A new app from Allianz Partners, a travel insurance provider that offers annual policies that are nearly all-inclusive, makes travel insurance easier to understand and less of a hassle to take advantage of. Allianz is known for its international health insurance and “nomad insurance” programs, putting it among the more forward-thinking of insurance companies in the travel space. Prior to a trip to Turkey earlier this year, I obtained an annual policy from Allianz, and plugged the policy into the company’s new app, Allyz TravelSmart, this week to see how it works. I filed a claim and researched my policy coverage, and I feel confident about both the app and my policy. Here’s why.

Why an annual travel insurance policy might work better for you

Photo: RootsShoots/Shutterstock

For frequent travelers, I see the value of travel insurance as being more along the lines of how frequent backcountry users emergency evacuation insurance. It’s there if you need it but after purchase doesn’t need to remain top of mind. In that sense, an annual policy makes sense, and because it covers the traveler for a year rather than a much shorter period, the cost is actually on par with what I’ve paid for policy terms of about one month in the past. Annual policies cover multiple trips and do not require the details of each trip to be inputted in advance – rather, you only deal with the insurance company if you need to file a claim or have a question about what might be covered.

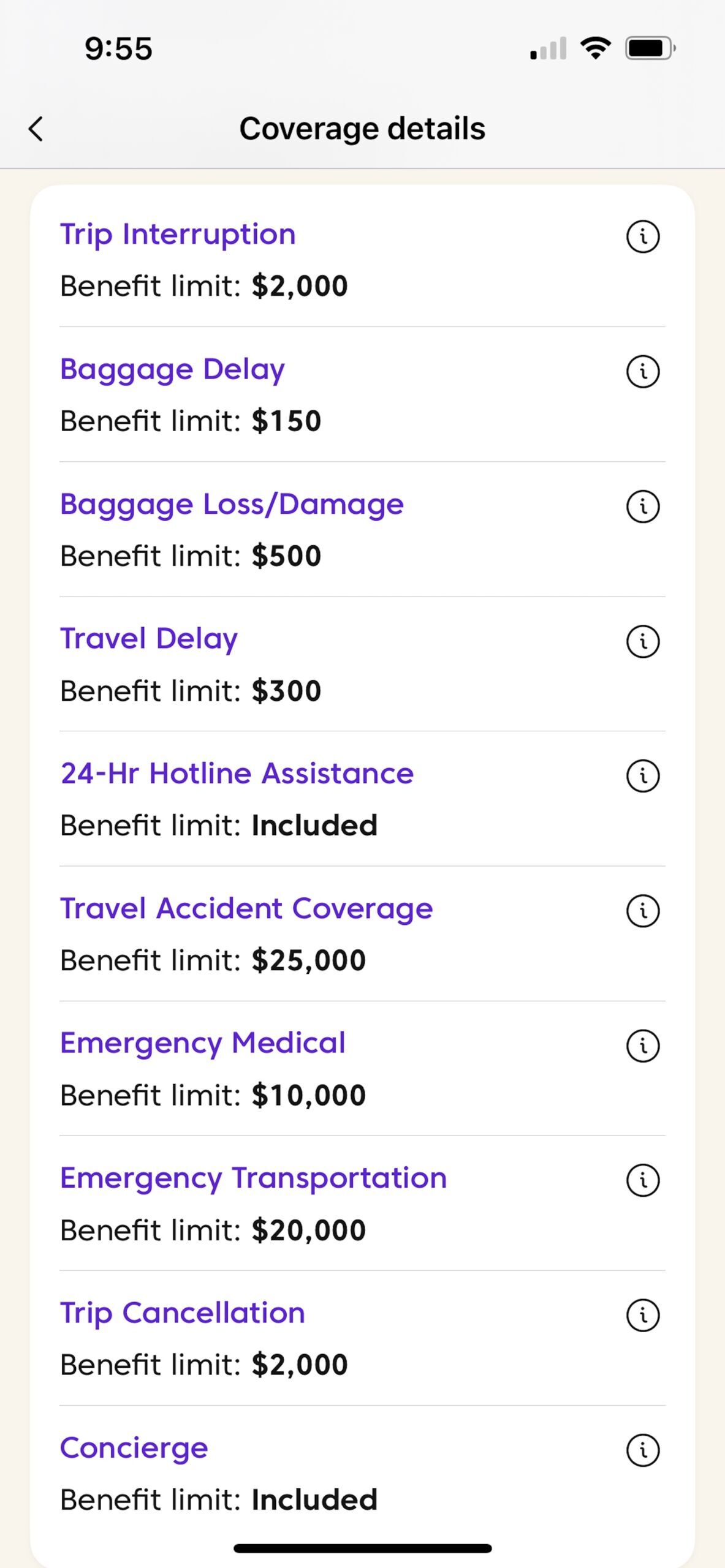

I learned about Allianz Partners annual travel insurance policies in January 2024, and after researching other options I determined the company’s Professional Travel Program to be the best for my needs as a travel editor who spends a month or more abroad per year and also frequently travels around the United States. Being a 40-year-old living in Colorado, I was quoted via the Allianz website three policies ranging from $138 to $510 for the year. The policy I ended up with includes travel accident coverage up to $25,000, emergency transportation (think an ambulance ride) up to $20,000, emergency medical coverage up to $10,000, trip cancelation and interruption coverage up to $2,000, and a host of smaller options like bag delay or loss and travel delay. Note that these are per insured person, per trip. Options for emergency and transportation coverage up to $100,000 are available on the more expensive policies.

How the Allyz TravelSmart app and claim process works

After downloading the app from the Apple App Store or Google Play, I was prompted to create a new account. Once doing so, I logged in to find that the app had already located my policy and integrated it into the app. The option to start a claim is right there on the homescreen. For the purpose of this article, I went through the claims application process to experience what it’s like.

Overall, the app’s user interface is similar to that of my home and auto insurance provider, which I’m confident was the company’s goal – give the users something they’re familiar with and that’s very simple, because when you’re already stressed about travel plans gone awry, you don’t want to struggle through a complicated claims process.

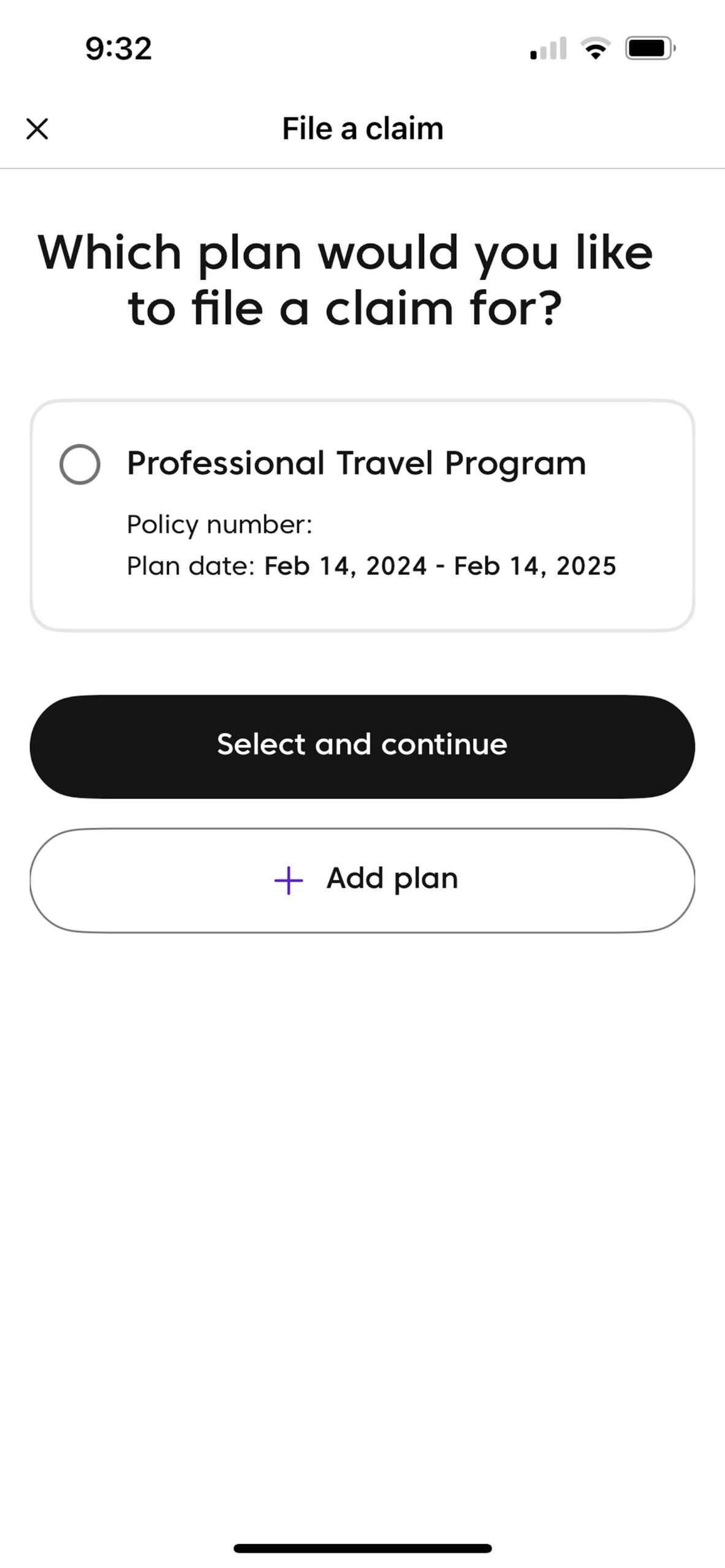

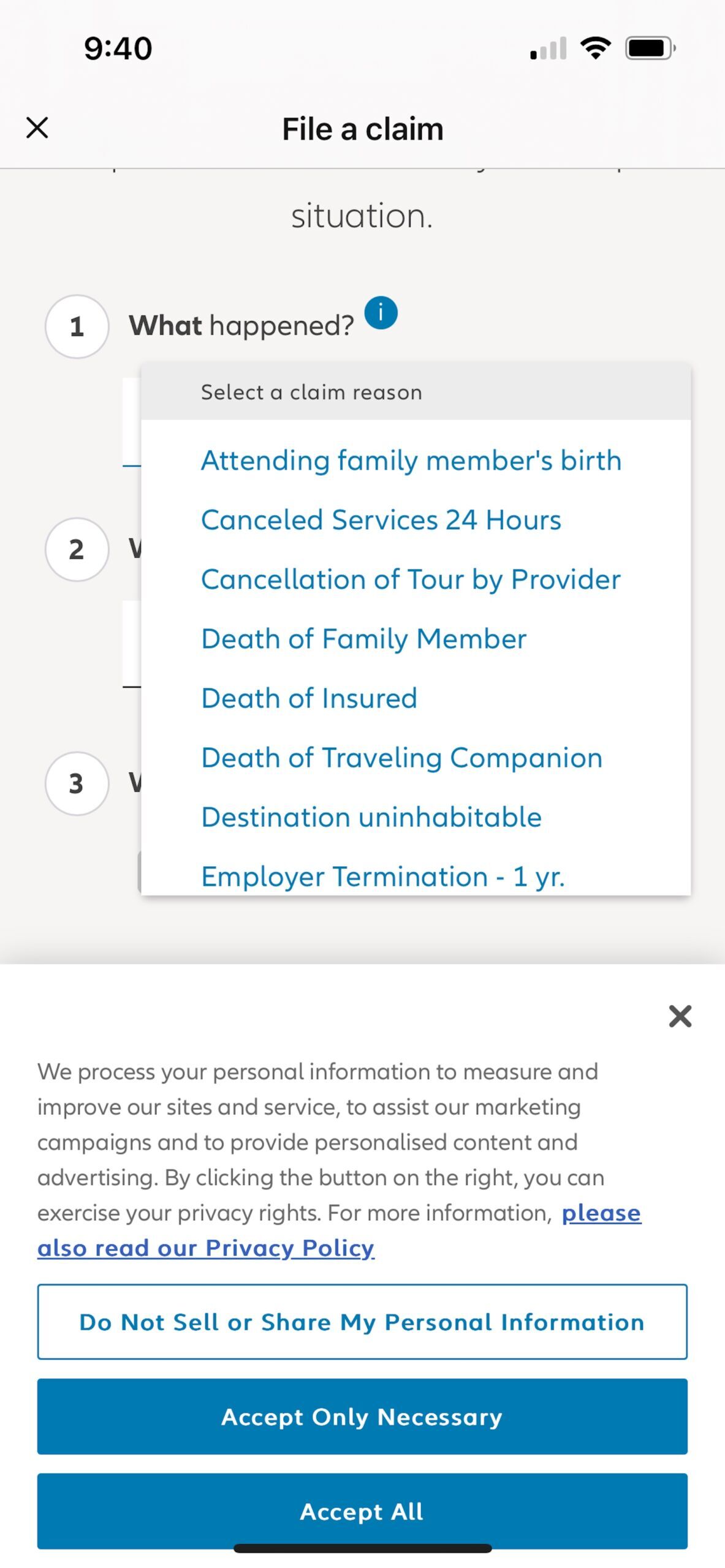

To file a claim, I clicked the button and selected my policy. I was then directed to a page that prompted me to enter the travel dates, destination(s), and other info about the trip, along with what happened. Importantly, it allows you to indicated whether something happened before leaving on the trip, or while already on the trip. I selected “Something happened before my trip,” and the app prompted me to select the “Trip Cancellation” insurance option.

The next step I found particularly interesting. My policy, the Professional Travel Policy, offers a host of reasons for cancelation that can be submitted for reimbursal consideration. Among the more comprehensive options were “Attending family member’s birth,” “Employer termination – 1 yr,” and “Employment Transfer.” This indicates that coverage can include reasons beyond illness, death, and cancellation by host/tour operator, etc. Also included is “Foreign and Domestic Terrorism,” notable because I’ve had policies in the past that did not cover terrorism incidents.

After selecting the reason (I chose “Flooding in Europe,” a listed reason provided on the app), I was prompted to enter details about the incident. Then, I was prompted to add the expenses I am seeking reimbursement for. Finally, there was a prompt to add any documents related to the claim. Before submitting I opted to have the expenses reimbursed into my checking account, and entered that information. After reviewing the information, I was prompted to submit. The entire process took fewer than 10 minutes, though the addition of a high number of documents or receipts would tack on a few additional minutes. The app noted that the company will follow up promptly once reviewing the claim and that the claim is typically processed within 10 business days.